Social security

Workers who enter into an employment contract with an employer in the Czech Republic (with the exception of an agreement on work performance ("DPP") of up to CZK 10,000/month or an agreement on work activity ("DPČ") of up to CZK 3,999/month) are registered by the employer in the social security insurance system with the Czech Social Insurance Administration and the employer pays for them monthly mandatory insurance premiums. Social security covers pension insurance, sickness insurance and unemployment insurance.

Health insurance

In the same way, the employer registers its employees with one of the public health insurance companies (UCT Prague with the General Health Insurance Company/VZP) and pays for them monthly mandatory insurance premiums.

After registration, a health insurance card is issued and delivered to foreigners via the UCT Prague Personnel Department.

Nationals of EU/EEA countries receive a blue card (EHIC), which entitles them to receive full health care in the Czech Republic and necessary health care in other EU/EEA countries.

The third country nationals receive a green card which entitles them to receive full health care in the Czech Republic only.

Foreigners, employees of UCT Prague, can register with doctors who have a contract with the VZP or relevant public health insurance company.

They can also register with a UCT Prague general practitioner.

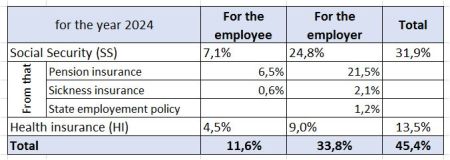

Premium rates

More detail information on https://accace.com/tax-guideline-for-the-czech-republic/

International scope of social and health insurance

EU, EEA and Switzerland nationals

European rules for the coordination of social security systems are based on the right of free movement of persons within Member States and the provision that a migrant is subject to the rules of only one Member State.

The European Regulations on social security coordination No. 883/2004 and No. 987/2009 do not supersede national systems, but only determine which country system will apply to a specific person (citizen, employee) in a particular situation. More information on Moving & working in Europe.

Third countries nationals

Some so-called contracting third countries have concluded international social security agreements with the Czech Republic, the basic purpose of which is to ensure the rights of persons migrating between the two contracting states. List of bilateral agreements and scope of provided social security is listed at https://www.mpsv.cz/web/en/social-security-of-migrants.

More information: Employment and Hosting of Foreigners in a Czech Academic Environment