If you are an EU citizen and pursue employed or self-employed activities in two or more member states, at the same time or in alternation, you have to determine only one member state of which the social security legislation applies to you.

You have to confirm this fact with the A1 certificate that you present to your employers, so that they know in which Member State your social and health insurance premium and statutory employer's liability insurance will be paid and where you can claim your social benefits. You must also inform about this fact or any changes the appropriate social security institution in the country of your residence.

Rules to determine applicable social security legislation

Determining which social security system is applicable to persons working in two or more member states or to self-employed persons is governed by rules in Article 13 of Regulation (EC) No 883/2004 on the coordination of social security systems and Regulation (EC) No 987/2009, which lays down the procedure for implementing these rules.

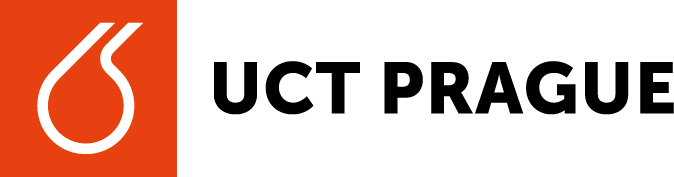

In a situation where you normally work as an employee, the first step is determining whether you carry out a substantial part (i.e. >25 %) of your activities in the Member State in which you reside. In Article 1, point (j) of Regulation No 883/2004 the residence is defined as the place where a person has his/her habitual residence.

The criteria for determining a substantial part of employment activities is either the proportion of working hours or the amount of renumeration expected in the following 12 calendar months.

The elements for determining residence are set out in Article 11 of Regulation (EC) No 987/2009:

If the answer is yes,

Article 13 Paragraph 1 of Regulation (EC) No 883/2004 states that the legislation of the Member State of residence applies. As a result, foreign employers from EU/EEA countries and Switzerland, or you yourself if you are self-employed, are obliged to pay social and health insurance premiums from incomes from other countries to the social security system of the country of residence.

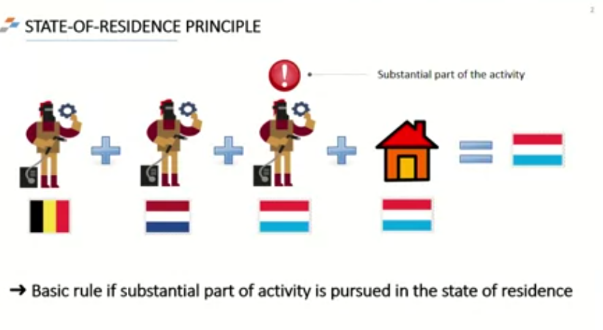

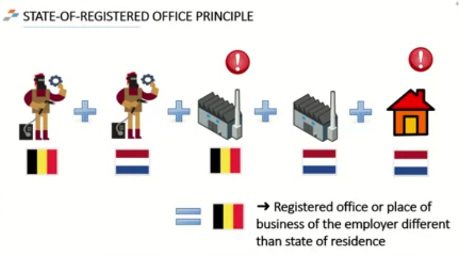

If the answer is no,

then Article 13 Paragraph 1 states that a person normally working in two or more Member States is subject to the legislation of the Member State determined according to the following criteria:

- The legislation of the Member State, in whose territory the registered office or place of business of the undertaking employing the person is situated, if the person does not pursue a substantial part of their activity in the Member State in whose territory they reside.

-

The legislation of a Member State other than the Member State of residence, in whose territory the registered office or place of business of the undertaking employing the person is situated, if the person is employed by two undertakings, one of which has its registered office in the Member State of residence but the person does not carry out a substantial part of their activity there, and the other in a different Member State, where the person carries out a substantial part of their activity.

The legislation of a Member State other than the Member State of residence, in whose territory the registered office or place of business of the undertaking employing the person is situated, if the person is employed by two undertakings, one of which has its registered office in the Member State of residence but the person does not carry out a substantial part of their activity there, and the other in a different Member State, where the person carries out a substantial part of their activity.  The legislation of the Member State in whose territory they reside, if they are employed by different undertakings or by different employers, whose registered offices or places of business are located in different Member States outside of the country of residence.

The legislation of the Member State in whose territory they reside, if they are employed by different undertakings or by different employers, whose registered offices or places of business are located in different Member States outside of the country of residence. - If the person pursues their activities as an employed person in two or more Member States on behalf of an employer established outside of the European Union, and if the person resides in a Member State but does not pursue a substantial activity there, regulations of the Member State of residence apply.

Determining the country of applicable social security legislation is often a complicated matter.

When concluding an employment contract with you, UCT Prague, as your employer, needs to know where you will carry out a substantial part of your activities and where your habitual residence is or will be.

If you will not be carrying out a substantial part of your activities at UCT Prague and/or your residence is/will be in another Member State, the Personnel department will ask you to present a PD A1 certificate, which specifies the Member State to whose social security legislations you will be subject to. UCT Prague is then obligated to pay from your income contributions to social and health insurance premiums and statutory employer's liability insurance to the system of that country, at rates set by the rules of that country, to whose legislation you are subject to according to your PD A1 certificate.

In case you work part-time at UCT Prague and you will start working in another Member State, it is necessary to determine, according to the criteria laid down in the Regulation EC 883/2004 and its implementing rules, the EC Regulation No. 987/2009, the Member State to whose legislation you will be subject to. Report this fact without any delay to the Personnel department. In case of change of the country whose social security legislation you are subject to, UCT Prague is obligated to pay social security contributions from your salary (or renumeration from part-time employment contracts) to the system of the country determined in the PD A1 certificate issued by the social security agency of the country to which you are/will be subject to.

If UCT Prague does not do so, it risks arrears on foreign social security and is subject to fines for not complying with the rules of the Coordination Regulations. In extreme cases, UCT Prague may claim compensation for damages incurred from you.

COURSERA Video "Pursuit of activities in two or more Member States"

Third country nationals (you are not an EU citizen)

- EU coordination rules

If you have a long-term residence permit in the Czech Republic for the purpose of scientific research and you perform a substantial part of your activities at UCT Prague, the Coordination Rules apply to you in the same way as to Czech employees of UCT Prague. The UCT Prague will have to pay contributions for social and health insurance premiums and the statutory employer's liability insurance to the system of the Czech Republic, and if you legally reside in the Czech Republic, you will be entitled to social benefits (excluding unemployment benefits).

If you legally reside in any EU Member State and you are in a situation that is not limited to a single Member State, e.g. you work for another organisation in another EU Member State, you will again be subject to the Coordination Regulation under Article 1 that expands upon the Regulation (EU) No 1231/2010. However, it does not apply to the United Kingdom, Ireland, Denmark, the EEA countries and Switzerland.

- Pursuit of activities in the Czech Republic and third countries

Bilateral social security agreements have been concluded between the Czech Republic and some third countries.

If you are a national of a contracting country or are a Czech citizen and will carry out activities in its territory, the rules laid down in the respective bilateral agreement will apply to you. The Czech Republic has concluded agreements with the following third countries:

Albania, Australia, Belarus, Bosnia and Herzegovina, Russia, Serbia, South Korea, Syria, Tunisia, Turkey, Ukraine, USA.

It is required to pay attention to which area of social security is covered by the relevant agreement; it does not have to cover the entire scope of social security as the EU Coordination Regulation. Some agreements do not include health insurance, but only pension insurance.

An overview of bilateral agreements and their scope can be found on the website of the Ministry of Labour and Social Affairs of the Czech Republic. Information on bilateral agreements concerning health insurance can be obtained from the Health Insurance Bureau (Kancelář zdravotního pojištění).

- Non-contracting countries

If you carry out activities in a country that has not concluded an agreement on social security with the Czech Republic, the basic rule is that the person pursuing activity in this country is subject to the legal regulations of the country of work.

For further questions, please contact Anna Mittnerová.